2023 Review: An Already Concerning Impact

New housing entered a crisis in 2023, with production declining by 7.8%1. Only 286,000 homes were built, a figure approaching historic lows reached in the 1990s2.

This crisis results from a combination of three negative factors: (1) the deterioration of the macro-financial environment, notably with rising interest rates; (2) the impact on production costs due to the materials crisis and the implementation of the RE2020 ecological regulations (energy sobriety and decarbonisation, reduction of carbon impact, and ensuring comfort during heatwaves); (3) the non-revaluation of housing subsidies (Pinel law) and an inflationary context, less favourable for investment.

The decline in activity is also evident in the number of business bankruptcies, which increased by 35% in 20233, particularly in the first half of the year; this represents the heaviest mid-year toll since 20164. With 13,266 legal safeguards, receiverships, and liquidations recorded across all sectors between April 1 and June 30, 20235, the phenomenon even surpasses pre-pandemic levels (13,000 in spring 20176).

The construction sector is struggling to withstand this surge in bankruptcies. The sector is experiencing a 35% increase in legal proceedings7, reaching 3,084 cases and now showing rapid growth, though not yet returning to pre-2020 levels. In the structural work sector (885 bankruptcies, +37%), the general masonry segment suffers the most (616 cases, +54%). In a similarly challenging context, the individual house construction sector recorded "only" 117 proceedings, an increase of 18% year-on-year. The finishing work sector (1,522 bankruptcies, +33%) is struggling much more, nearly returning to its level of the second quarter of 2019 (1,575 bankruptcies).

Certain activities, such as electrical installations, insulation, or waterproofing works, have reverted to their situation in the second quarter of 2016. In public works (170 cases, +24%), the deterioration is mainly due to earthworks, which have returned to their level of the second quarter of 2014.

Real estate is also very poorly oriented due to 190 real estate agency bankruptcies. This figure represents an increase of 104%, the worst level since 2014, caused by the tightening of lending conditions. The rapid rise in interest rates has excluded many buyers from the market, particularly first-time homebuyers, whose incomes are also being eroded by inflation.

Mortgage rates have thus quadrupled in less than two years, reaching an average of 3.81%. This increase has made access to credit difficult for households, impacting their construction projects. The production of new housing loans, excluding renegotiation, fell below the 10 billion euro mark in August 2023 (9.9 billion)9, a level not seen since March 2016.

Despite a 4% drop in prices in 202310, this decline spares no category of property. The drop is comparable for apartments (4.1%) and houses (3.8%), with the increase in property taxes further aggravating the situation. This decline now affects almost the entire territory, although it is much more severe in Île-de-France, with a decrease of 6.9% compared to 2.9% on average for other regions10.

The new construction sector also plunged significantly in 2023, with a notable 32.6%11 decrease in overall demand. Among households seeking to acquire a primary residence, the decline reached 29.1%. The decline is even more pronounced among investors, with demand collapsing by 44%. This decline is partly explained by the gradual elimination of the Pinel scheme, which offered a significant tax advantage for the purchase of new housing intended for rental.

The impact on employment from these various findings is mechanical and immediate. The plan to cut over 500 jobs announced by Nexity in April 202412, France's leading real estate developer, serves as a stark reminder of the feared damage within the sector.

This crisis results from a combination of three negative factors: (1) the deterioration of the macro-financial environment, notably with rising interest rates; (2) the impact on production costs due to the materials crisis and the implementation of the RE2020 ecological regulations (energy sobriety and decarbonisation, reduction of carbon impact, and ensuring comfort during heatwaves); (3) the non-revaluation of housing subsidies (Pinel law) and an inflationary context, less favourable for investment.

The decline in activity is also evident in the number of business bankruptcies, which increased by 35% in 20233, particularly in the first half of the year; this represents the heaviest mid-year toll since 20164. With 13,266 legal safeguards, receiverships, and liquidations recorded across all sectors between April 1 and June 30, 20235, the phenomenon even surpasses pre-pandemic levels (13,000 in spring 20176).

The construction sector is struggling to withstand this surge in bankruptcies. The sector is experiencing a 35% increase in legal proceedings7, reaching 3,084 cases and now showing rapid growth, though not yet returning to pre-2020 levels. In the structural work sector (885 bankruptcies, +37%), the general masonry segment suffers the most (616 cases, +54%). In a similarly challenging context, the individual house construction sector recorded "only" 117 proceedings, an increase of 18% year-on-year. The finishing work sector (1,522 bankruptcies, +33%) is struggling much more, nearly returning to its level of the second quarter of 2019 (1,575 bankruptcies).

Certain activities, such as electrical installations, insulation, or waterproofing works, have reverted to their situation in the second quarter of 2016. In public works (170 cases, +24%), the deterioration is mainly due to earthworks, which have returned to their level of the second quarter of 2014.

Real estate is also very poorly oriented due to 190 real estate agency bankruptcies. This figure represents an increase of 104%, the worst level since 2014, caused by the tightening of lending conditions. The rapid rise in interest rates has excluded many buyers from the market, particularly first-time homebuyers, whose incomes are also being eroded by inflation.

Mortgage rates have thus quadrupled in less than two years, reaching an average of 3.81%. This increase has made access to credit difficult for households, impacting their construction projects. The production of new housing loans, excluding renegotiation, fell below the 10 billion euro mark in August 2023 (9.9 billion)9, a level not seen since March 2016.

Despite a 4% drop in prices in 202310, this decline spares no category of property. The drop is comparable for apartments (4.1%) and houses (3.8%), with the increase in property taxes further aggravating the situation. This decline now affects almost the entire territory, although it is much more severe in Île-de-France, with a decrease of 6.9% compared to 2.9% on average for other regions10.

The new construction sector also plunged significantly in 2023, with a notable 32.6%11 decrease in overall demand. Among households seeking to acquire a primary residence, the decline reached 29.1%. The decline is even more pronounced among investors, with demand collapsing by 44%. This decline is partly explained by the gradual elimination of the Pinel scheme, which offered a significant tax advantage for the purchase of new housing intended for rental.

The impact on employment from these various findings is mechanical and immediate. The plan to cut over 500 jobs announced by Nexity in April 202412, France's leading real estate developer, serves as a stark reminder of the feared damage within the sector.

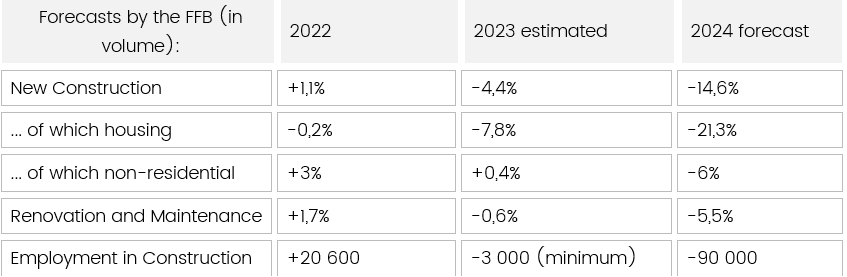

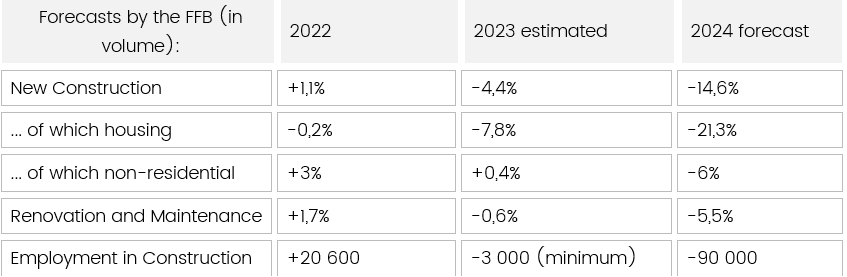

2024 Already in Crisis, the Construction Sector Braces for the Worst

For 2024, a recession in the construction sector becomes inevitable. Olivier Salleron, President of the French Building Federation (FFB), is very pessimistic about the sector's short-term future.

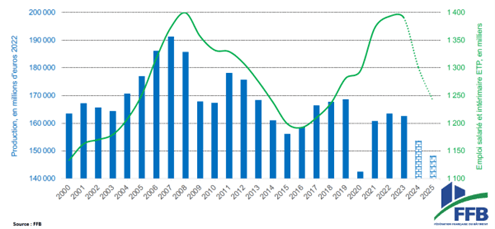

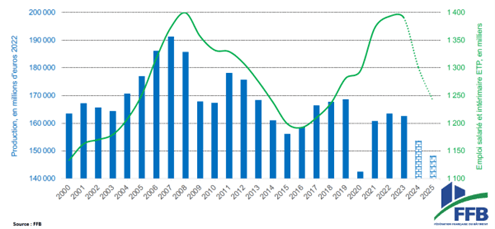

With a 0.6% decline in activity in 202313, the downturn continues in 2024 with a predicted drop of around 5.5%. New housing, which accounts for 30% of the building activity, is dragging the entire sector down. Only 241,000 new housing units are projected for 2024, a level not seen for 30 to 40 years. With a turnover decrease of 21% to 30%, the projected volume decline for new non-residential construction in 2024 is 6%.

The forecasts for 2025 are even lower than those for 2024: production volumes are expected to drop to less than 150 million euros, and employment is projected to remain below 1,15014.

The decline in the sector's turnover, expected to be -5.5% in 202415, is anticipated to worsen, reaching -9% in 2025. The crisis could result in the loss of between 150,000 to 300,000 jobs in construction by 202516. Salaried employment in the sector decreased by 0.2% in the fourth quarter of 202317, bringing the annual cumulative decline to 0.7%, equivalent to a loss of 1,500 jobs.

With a 0.6% decline in activity in 202313, the downturn continues in 2024 with a predicted drop of around 5.5%. New housing, which accounts for 30% of the building activity, is dragging the entire sector down. Only 241,000 new housing units are projected for 2024, a level not seen for 30 to 40 years. With a turnover decrease of 21% to 30%, the projected volume decline for new non-residential construction in 2024 is 6%.

The forecasts for 2025 are even lower than those for 2024: production volumes are expected to drop to less than 150 million euros, and employment is projected to remain below 1,15014.

The decline in the sector's turnover, expected to be -5.5% in 202415, is anticipated to worsen, reaching -9% in 2025. The crisis could result in the loss of between 150,000 to 300,000 jobs in construction by 202516. Salaried employment in the sector decreased by 0.2% in the fourth quarter of 202317, bringing the annual cumulative decline to 0.7%, equivalent to a loss of 1,500 jobs.

French Real Estate Giants in Difficulty

French developers and builders are caught in a squeeze between rising construction costs driven by material prices, stricter environmental regulations, and a collapse in demand caused by difficulties in accessing credit and the gradual phasing out of incentive tax schemes.

Vinci

Vinci Immobilier was the first to initiate measures in early 202418. An employment safeguard plan was presented to the company’s social partners, starting with a voluntary departure plan. The group refuses to disclose the number of jobs affected.Nexity

In February 2024, Nexity, France's leading property developer with 8,200 employees, announced that it was facing an "unprecedented crisis" in the group’s history. After recording a double-digit decline in activity in the first quarter, the promotion and construction branch is directly impacted: in 2023, housing reservations fell by 19% in number and 24% in value; sales dropped by 30% compared to 2022. To cope, the group announced the implementation of an employment safeguard plan (PSE) affecting nearly 500 positions19.Bouygues Immobilier

Bouygues Immobilier, a subsidiary of the Bouygues group, plans to cut 225 jobs through a social plan announced in early March 202420. In 2023, Bouygues Immobilier suffered a net loss of 7 million euros (compared to a profit of 18 million in 2022) on a revenue of 1.7 billion euros, a decrease of 14.5% compared to the previous year.Which solutions?

MaPrimeRénov

Despite the increase in the MaPrimeRénov budget announced during 2023, with the budget rising from 2.4 billion to 5 billion euros, the rise in activity remains uncertain. The measure has been adjusted. Simple renovation actions, such as window, floor, or wall insulation, no longer allowed for claiming the full grant. Furthermore, households were required to change their heating systems before or simultaneously with other renovation actions, bringing the minimum investment to 10,000 or 15,000 euros for just the boiler.This tightening of the MaPrimeRénov scheme led to a significant postponement of work21, prompting the government to announce a transitional adjustment to the grant in May 202422, valid until 31 December. This adjustment reauthorises single renovation actions to claim the grant and removes the requirement to provide energy performance diagnostics (DPE). While these changes could offer a breather to the sector, as could the announcement of a future "energy pact" by the end of 2024, it should be noted that in February 2024, Economy Minister Bruno Le Maire announced a 1 billion euro cut in the MaPrimeRénov23 budget due to a higher-than-expected public deficit (5.5% actual vs. the projected 4.9%24).

MaPrimeAdapt

Since 1 January 202425 and the end of the Pinel scheme, MaPrimeAdapt' has become the sole solution for financing home adaptation works. It is aimed at people with disabilities and the elderly. MaPrimeAdapt' can finance up to 50% or 70% of the cost of the work, depending on income, with a maximum limit of 22,000 euros excluding taxes. Although 12,000 to 15,000 companies or craftsmen are currently involved in home adaptation26, the MaPrimeAdapt' allocation is only 500 million euros (a budget of 1.5 billion euros spread over the last three years of the five-year term), far from the 14 billion euros shortfall projected by 202527.EduRénov or School Renovation in the Context of Energy Renovation

With 53,000 establishments in mainland France and overseas, and a total area of nearly 130 million square metres, thermal renovation of school buildings represents a major challenge for local authorities. However, this extensive and dispersed stock remains difficult to manage: 80% of schools are in rural areas, 60% have fewer than five classes, and their area does not exceed 1,000 square metres. The first phase of the EduRénov scheme involves renovating 10,000 schools by 2027, with a budget of 2 billion euros28. An additional 50 million euros in "engineering credits" over five years has also been announced to support local authorities in their energy performance diagnostics and work programme preparation.Zero-Interest Loan (PTZ)

Access conditions have been revised since October 202329 to expand the scheme to more French households. This state-supported loan, which assists households in purchasing their first principal residence based on income levels, has seen its access criteria relaxed and income thresholds for eligibility revalued for the first time since 2016. This should benefit an additional 6 million households, bringing the total number of eligible households to 29 million. The scheme, which was due to end in late 2023, has been extended until 2027, with new provisions applicable from 1 April 2024.Towards Lower Interest Rates?

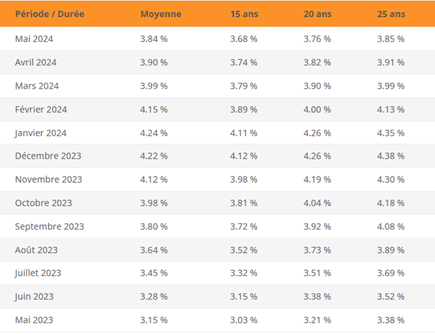

After a steep rise over two years, from around 1% in January 2022 to 4.15% in February 202430, interest rates have started to decrease in recent weeks. However, this decrease seems fragile: only 20% of banks revised their rates downwards in April, with the majority leaving their rates unchanged.In April 2024, interest rates stabilised at an average of 3.82%31 for 20-year32 loans, 3.74% for 15-year loans, and 3.91% for 25-year loans. The best profiles, given the sector's conditions (significant down payment combined with young age)33, can still negotiate better rates:

What About the International Context?

SIGNA in Austria

After a spectacular rise under the leadership of Austrian billionaire René Benko, Signa Holding, one of Europe's most prestigious real estate empires, founded in 2000, filed for bankruptcy at the end of November 2023. The board of directors of SIGNA Prime Selection AG requested the initiation of insolvency restructuring proceedings a month later. Signa owns German gems such as the famous KaDeWe department store in Berlin, the unfinished Elbtower in Hamburg, and the Park Hyatt Palace in Vienna. The value of these assets exceeds 20 billion euros. Another subsidiary, Signa Development Selection AG, also filed for restructuring at the end of February 2023 . This subsidiary specialises in real estate transactions for office spaces, residential units, and hotels in Vienna, with assets totalling 4.6 billion euros .Evergrande in China

Symbolising the Chinese real estate crisis, the developer Evergrande, China’s largest real estate company with 200,000 employees, had a debt of 328 billion dollars in 2023. After failing to present a convincing restructuring plan, its international creditors filed a liquidation petition against the group in 2023 with a Hong Kong37 court. Evergrande's liquidation was pronounced at the end of January 202438, causing its stock to plummet by over 20%, prompting the Hong Kong Stock Exchange to suspend its trading. The announcement plunged thousands of creditors into uncertainty regarding their chances of recovering their funds. Evergrande's downfall, first defaulting on payments in 2021 and already declared bankrupt in the United States, was closely monitored by Chinese authorities, as the group is a pillar of the country's economy.The major question now is the possible contagion to other real estate developers: some of them are also in significant financial trouble and near bankruptcy. In December 202339, out of the 70 major Chinese cities that make up the official reference indicator, 62 recorded a new drop in property prices over a month40, compared to "only" 34 in January 2023. Concerns are high, given that the construction and real estate sector represents more than a quarter of China's GDP.

Auteur : Sofiane BOUABDELI

Chargé d’arbitrage

Servyr Poste Clients │ Groupe Fibus

sbouabdeli@fibus.com

Mai 2024

Chargé d’arbitrage

Servyr Poste Clients │ Groupe Fibus

sbouabdeli@fibus.com

Mai 2024

_

1 https://www.ledauphine.com/magazine-immobilier/2023/12/18/marche-du-logement-neuf-la-situation-va-t-elle-s-ameliorer-en-2024 - 18/12/2023

2 https://www.ledauphine.com/magazine-immobilier/2023/12/18/marche-du-logement-neuf-la-situation-va-t-elle-s-ameliorer-en-2024 18/12/2023

3 https://www.latribune.fr/entreprises-finance/les-defaillances-d-entreprises-atteignent-des-niveaux-records-en-2023-988170.html - 18/01/2024

4 https://www.altares.com/wp-content/uploads/07_2023_ALTARES_CP_DEFAILLANCES_T2_2023.pdf 07/2023 12/07/2023

5 https://www.altares.com/wp-content/uploads/07_2023_ALTARES_CP_DEFAILLANCES_T2_2023.pdf 12/07/2023

6 https://www.altares.com/wp-content/uploads/07_2023_ALTARES_CP_DEFAILLANCES_T2_2023.pdf 12/07/2023

7 https://www.batiactu.com/edito/btp-tente-resister-tant-bien-que-mal-a-hausse-faillites-66657.php 17/07/2023

8 https://www.journaldeleconomie.fr/Baisse-inedite-de-la-production-de-nouveaux-credits-immobiliers-en-France_a12826.html 06/10/2023

9 https://www.insee.fr/fr/statistiques/7928596#:~:text=Sur%20un%20an%2C%20les%20prix,%2C8%20%25%20pour%20les%20maisons. 29/02/2024

10 https://www.insee.fr/fr/statistiques/7928596#:~:text=Sur%20un%20an%2C%20les%20prix,%2C8%20%25%20pour%20les%20maisons. 29/02/2024

11 https://www.pap.fr/blog/limmobilier-neuf-subit-une-chute-de-32-de-la-demande/a24478 29/02/2024

12 https://www.batiactu.com/edito/nexity-annonce-suppressions-postes-68426.php 25/04/2024

13 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

14 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

15 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

16 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

17 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

18 https://www.lesechos.fr/industrie-services/immobilier-btp/vinci-immobilier-premier-grand-promoteur-a-lancer-un-plan-social-2046463 15/01/2024

19 https://investir.lesechos.fr/actu-des-valeurs/la-vie-des-actions/nexity-le-chiffre-daffaires-a-recule-de-14-au-t1-le-plan-social-concerne-500-postes-2091302 - 25/02/2024

20 https://www.capital.fr/entreprises-marches/plan-social-a-venir-chez-le-geant-de-la-construction-bouygues-immobilier-1494993 09/04/2024

21 https://www.batiactu.com/edito/anah-devoile-bilan-chiffre-maprimerenov-au-premier-68390.php 23/03/2024

22 https://www.service-public.fr/particuliers/actualites/A17134 - 60/05/2024

23 https://www.expertise-renovation.com/actualites/un-milliard-moins-maprimerenov/ 19/02/2024

24 https://www.publicsenat.fr/actualites/parlementaire/deficit-2023-a-ete-une-annee-noire-pour-les-finances-publiques-alerte-pierre-moscovici 30/04/2024

25 Au niveau de l’adaptation du logement pour les personnes en situation de handicap ou en perte d’autonomie et mis en place le 01/01/2024

https://www.monparcourshandicap.gouv.fr/actualite/maprimeadapt-une-aide-unique-ladaptation-des-logements-depuis-le-1er-janvier-2024 17/11/2023

26 https://www.batiweb.com/actualites/legislation/maprimeadapt-la-filiere-silver-economie-en-effervescence-43452 12/12/2023

27 https://www.lesechos.fr/industrie-services/immobilier-btp/crise-de-limmobilier-le-batiment-pense-perdre-150000-emplois-en-deux-ans-2041241 13/12/24

28 https://lebatimentperformant.fr/actualites/reno-des-ecoles-le-dispositif-edurenov-va-pouvoir-etre-lance/1/5667 08/04/2024

29 https://www.economie.gouv.fr/actualites/pret-taux-zero-conditions-acces-plus-souples-6-millions-foyers-supplementaires# 05/04/2024

30 https://www.immobilier-danger.com/evolution-taux-immobilier.html 01/05/2024

31 https://www.immobilier-danger.com/evolution-taux-immobilier.html 01/05/2024

32 https://www.immobilier-danger.com/evolution-taux-immobilier.html 01/05/2024

33 https://www.immobilier-danger.com/evolution-taux-immobilier.html - 7/05/24

34 https://fr.fashionnetwork.com/news/Deux-filiales-du-groupe-immobilier-signa-dont-une-qui-detient-le-magasin-kadewe-a-berlin-en-restructuration,1589943.html 28/12/2023

35 https://www.bilan.ch/story/faillite-immobiliere-deux-filiales-de-signa-demandent-un-plan-de-restructuration-712559407470 28/12/2023

36 https://www.bilan.ch/story/faillite-immobiliere-deux-filiales-de-signa-demandent-un-plan-de-restructuration-712559407470 28/12/2023

37 https://www.france24.com/fr/%C3%A9co-tech/20240129-un-tribunal-de-hong-kong-ordonne-la-liquidation-du-promoteur-chinois-evergrande 29/01/2024

38 https://www.courrierinternational.com/article/immobilier-l-effondrement-du-groupe-evergrande-revele-les-failles-de-l-economie-chinoise 17/02/2024

39 https://www.lesechos.fr/finance-marches/marches-financiers/en-chine-une-nouvelle-baisse-de-taux-pour-soutenir-limmobilier-2077284 - 20/02/2024

40 https://asialyst.com/fr/2024/02/03/evergrande-liquidation-peur-effet-domino-immobilier-chine/ 03/02/2024

_

1 https://www.ledauphine.com/magazine-immobilier/2023/12/18/marche-du-logement-neuf-la-situation-va-t-elle-s-ameliorer-en-2024 - 18/12/2023

2 https://www.ledauphine.com/magazine-immobilier/2023/12/18/marche-du-logement-neuf-la-situation-va-t-elle-s-ameliorer-en-2024 18/12/2023

3 https://www.latribune.fr/entreprises-finance/les-defaillances-d-entreprises-atteignent-des-niveaux-records-en-2023-988170.html - 18/01/2024

4 https://www.altares.com/wp-content/uploads/07_2023_ALTARES_CP_DEFAILLANCES_T2_2023.pdf 07/2023 12/07/2023

5 https://www.altares.com/wp-content/uploads/07_2023_ALTARES_CP_DEFAILLANCES_T2_2023.pdf 12/07/2023

6 https://www.altares.com/wp-content/uploads/07_2023_ALTARES_CP_DEFAILLANCES_T2_2023.pdf 12/07/2023

7 https://www.batiactu.com/edito/btp-tente-resister-tant-bien-que-mal-a-hausse-faillites-66657.php 17/07/2023

8 https://www.journaldeleconomie.fr/Baisse-inedite-de-la-production-de-nouveaux-credits-immobiliers-en-France_a12826.html 06/10/2023

9 https://www.insee.fr/fr/statistiques/7928596#:~:text=Sur%20un%20an%2C%20les%20prix,%2C8%20%25%20pour%20les%20maisons. 29/02/2024

10 https://www.insee.fr/fr/statistiques/7928596#:~:text=Sur%20un%20an%2C%20les%20prix,%2C8%20%25%20pour%20les%20maisons. 29/02/2024

11 https://www.pap.fr/blog/limmobilier-neuf-subit-une-chute-de-32-de-la-demande/a24478 29/02/2024

12 https://www.batiactu.com/edito/nexity-annonce-suppressions-postes-68426.php 25/04/2024

13 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

14 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

15 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

16 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

17 https://www.batirama.com/article/67703-recession-inevitable-pour-le-btp-en-2024-et-2025-reveillez-vous-s-insurge-la-ffb.html 13/12/2023

18 https://www.lesechos.fr/industrie-services/immobilier-btp/vinci-immobilier-premier-grand-promoteur-a-lancer-un-plan-social-2046463 15/01/2024

19 https://investir.lesechos.fr/actu-des-valeurs/la-vie-des-actions/nexity-le-chiffre-daffaires-a-recule-de-14-au-t1-le-plan-social-concerne-500-postes-2091302 - 25/02/2024

20 https://www.capital.fr/entreprises-marches/plan-social-a-venir-chez-le-geant-de-la-construction-bouygues-immobilier-1494993 09/04/2024

21 https://www.batiactu.com/edito/anah-devoile-bilan-chiffre-maprimerenov-au-premier-68390.php 23/03/2024

22 https://www.service-public.fr/particuliers/actualites/A17134 - 60/05/2024

23 https://www.expertise-renovation.com/actualites/un-milliard-moins-maprimerenov/ 19/02/2024

24 https://www.publicsenat.fr/actualites/parlementaire/deficit-2023-a-ete-une-annee-noire-pour-les-finances-publiques-alerte-pierre-moscovici 30/04/2024

25 Au niveau de l’adaptation du logement pour les personnes en situation de handicap ou en perte d’autonomie et mis en place le 01/01/2024

https://www.monparcourshandicap.gouv.fr/actualite/maprimeadapt-une-aide-unique-ladaptation-des-logements-depuis-le-1er-janvier-2024 17/11/2023

26 https://www.batiweb.com/actualites/legislation/maprimeadapt-la-filiere-silver-economie-en-effervescence-43452 12/12/2023

27 https://www.lesechos.fr/industrie-services/immobilier-btp/crise-de-limmobilier-le-batiment-pense-perdre-150000-emplois-en-deux-ans-2041241 13/12/24

28 https://lebatimentperformant.fr/actualites/reno-des-ecoles-le-dispositif-edurenov-va-pouvoir-etre-lance/1/5667 08/04/2024

29 https://www.economie.gouv.fr/actualites/pret-taux-zero-conditions-acces-plus-souples-6-millions-foyers-supplementaires# 05/04/2024

30 https://www.immobilier-danger.com/evolution-taux-immobilier.html 01/05/2024

31 https://www.immobilier-danger.com/evolution-taux-immobilier.html 01/05/2024

32 https://www.immobilier-danger.com/evolution-taux-immobilier.html 01/05/2024

33 https://www.immobilier-danger.com/evolution-taux-immobilier.html - 7/05/24

34 https://fr.fashionnetwork.com/news/Deux-filiales-du-groupe-immobilier-signa-dont-une-qui-detient-le-magasin-kadewe-a-berlin-en-restructuration,1589943.html 28/12/2023

35 https://www.bilan.ch/story/faillite-immobiliere-deux-filiales-de-signa-demandent-un-plan-de-restructuration-712559407470 28/12/2023

36 https://www.bilan.ch/story/faillite-immobiliere-deux-filiales-de-signa-demandent-un-plan-de-restructuration-712559407470 28/12/2023

37 https://www.france24.com/fr/%C3%A9co-tech/20240129-un-tribunal-de-hong-kong-ordonne-la-liquidation-du-promoteur-chinois-evergrande 29/01/2024

38 https://www.courrierinternational.com/article/immobilier-l-effondrement-du-groupe-evergrande-revele-les-failles-de-l-economie-chinoise 17/02/2024

39 https://www.lesechos.fr/finance-marches/marches-financiers/en-chine-une-nouvelle-baisse-de-taux-pour-soutenir-limmobilier-2077284 - 20/02/2024

40 https://asialyst.com/fr/2024/02/03/evergrande-liquidation-peur-effet-domino-immobilier-chine/ 03/02/2024

_

These articles may interest you

New signings of Fibus in November 2024

Key achievements supporting growth in retail, industry, equipment, and merchandising... Fibus identifies the best financing solutions to optimize your working capital needs by leveraging your accounts receivable:

- Financing through Factoring and Credit Insurance,

- Securing through Credit Insurance,

- Ongoing optimization of financing with dedicated software solutions.

How to choose the right factoring solution ?

Traditional or fintech, standard or tailored… here are some key insights to help you navigate a vast array of options. Read the article from Le Nouvel Économiste for a clearer understanding of the different factoring financing solutions available.

New signings of Fibus in September 2024

5 cases among our latest signings achieved in Factoring, Trade and Digital, in France and international, for ETI and big groups. The business sectors for these signings : manufacture, wholesale, telecommunications and treatment and disposal of non-hazardous waste.

Fibus' expertise covers 100% of factoring needs, including credit insurance and digital solutions for monitoring programmes.

Fibus' expertise covers 100% of factoring needs, including credit insurance and digital solutions for monitoring programmes.

Contact us, so that, together, we can find the best solution for financing your accounts receivable.

Write us